The Global Electronic Association recently released a report called "International World: Global Electronic Trade in the Age of Dynamics", and found that the trade scale of zero-assembly products exceeds the end products, including semicon...

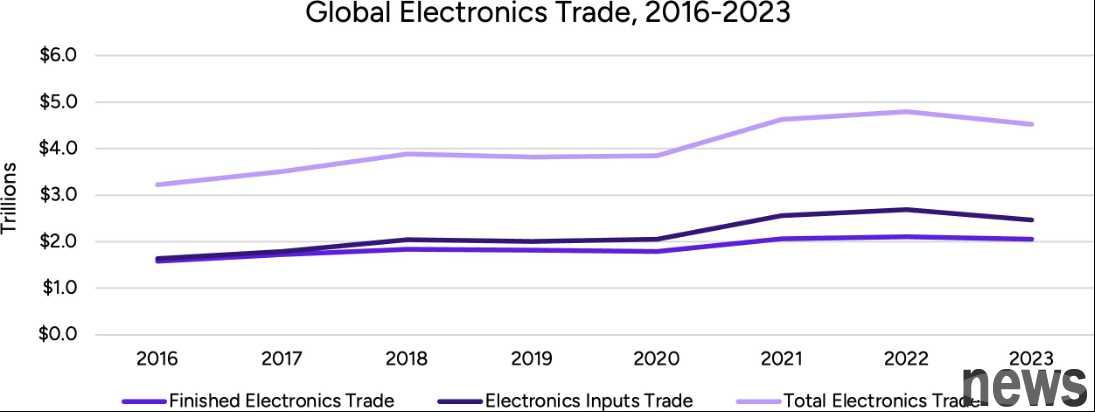

The Global Electronic Association recently released a report called "International World: Global Electronic Trade in the Age of Dynamics", and found that the trade scale of zero-assembly products exceeds the end products, including semiconductors, connectors and batteries, the total cross-border transaction amount exceeds US$2.5 trillion, higher than the US$2 trillion for electronic end products such as mobile phones and laptops.

In other words, the total trade value of electronic raw materials has exceeded that of the final products, showing the high degree of complexity, advancedness and professional division of labor in today's electronic manufacturing.

In addition, the total commodity trade volume of electronic industries reached US$4.5 trillion in 2023, accounting for more than 20% of the total global commodity trade volume, accounting for one-fifth of the world's current trade volume. In contrast, it is often regarded as a highly transnational chain-supplying vehicle industry, which paid only a global trade amount of about $1.8 trillion in the same year.

From the perspective of the country, China imported up to US$63 billion of electronic components in 2023, surpassing the total of the three major components imported from the United States, the European Union and Singapore. This also highlights that even the world's largest exporter of electronic terminal products is highly dependent on global component supply. As for the fastest-growing electronic terminal products exporting countries such as Vietnam and India, they are also the fastest-growing electronic components import countries.

Among them, from 2017 to 2023, the import of electronic components in India grew by 122%, while Vietnam grew by 83%. After China, the European Union and the United States are the world's largest exporters of electronic terminal products, and are also China's import countries for electronic components only.

The Global Electronics Association pointed out that Vietnam, India and Mexico can rapidly rise to become the end product assembly center in the electronic manufacturing field, not because of the complete vertical industry link integration, but because it has successfully embedded a production network with global division of labor. In other words, trade is currently “diversified” rather than “destroying”.

Among them, trade in Asia accounts for 88% of the import of Asian electronic components and 69% of the import of electronic terminal products, indicating intensive industry integration in the region rather than supply chain breaks. In the United States, although the tax imposed on Chinese goods has changed the purchasing model, it has not really cut off its dependence on global zero components, but has only directed trade to other alternative partners.

As for the new economics that are mainly used for the end product assembly, such as India and other countries, the key to continuously improving production capacity and competition is to expand the import of its electronic components. The imperative nature of upstream supply chains directly affects a country's ability to expand production scale and compete with global markets. All economics must combine their industry policies with the international purchasing strategies of key components in order to strengthen global competition.

The Global Electronic Association "Research Plan for the Flow of Electronic Industry Trade" covers about 150 economic entities and conducts detailed tracking of electronic raw materials and electronic end products. All data sources are from the United Nations Comtrade database, which can provide a consistent and complete analysis basis even if data distribution is different in each country.

Extended reading: Apple's new product specifications will be revealed next year! The iPhone 17e that is expected to be launched is "changed annually" DeepSeek usage rate dropped from 50% to 3%, and the R2 model release time delayed